Introduction

The cup and handle pattern is a powerful bullish chart pattern, but its success hinges on proper identification. Not every U-shaped formation qualifies as a valid cup and handle. To trade this pattern effectively, you need to follow specific rules that ensure its reliability. This guide outlines the key rules for valid cup and handle patterns, helping traders in stocks, forex, and cryptocurrencies avoid mistakes and capitalize on bullish opportunities. Let’s explore the essential criteria for spotting a true cup and handle pattern.

What is the Cup and Handle Pattern?

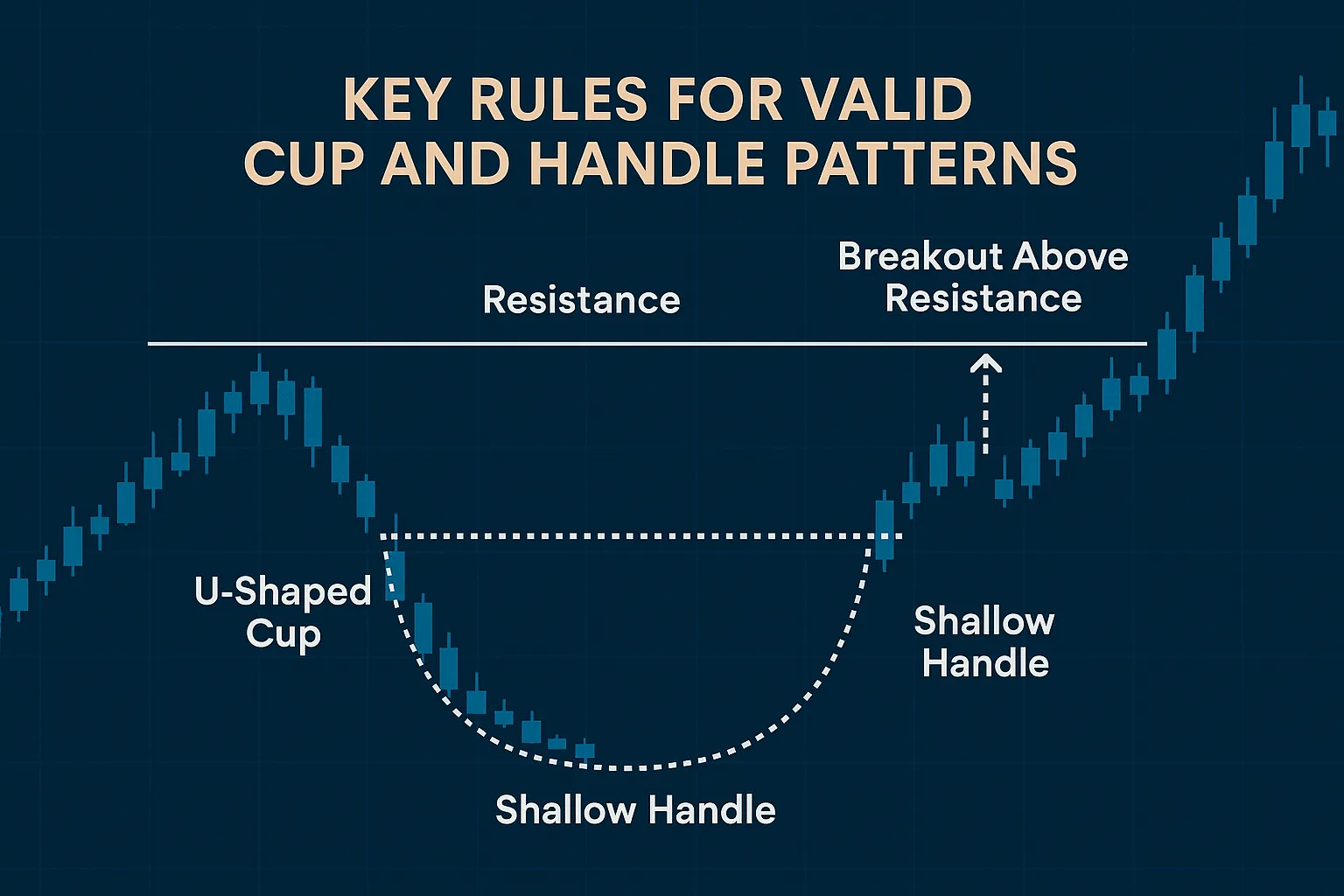

The cup and handle pattern is a bullish continuation chart pattern that signals a potential price increase after a prior uptrend. It consists of:

- Cup: A U-shaped consolidation phase, resembling a bowl, where the price dips and recovers.

- Handle: A short, downward-sloping pullback that sets the stage for a breakout.

A valid pattern requires specific characteristics in shape, duration, depth, and volume. Following these rules helps traders confirm the pattern’s strength and avoid false signals.

Key Rules for Valid Cup and Handle Patterns

To ensure a cup and handle pattern is legitimate, adhere to these five essential rules:

- Prior Uptrend:

The pattern must form after a clear upward price movement (e.g., 10–30% or more). This uptrend establishes the bullish context, as the cup and handle is a continuation pattern, not a reversal pattern. - U-Shaped Cup:

The cup should have a smooth, rounded, U-shaped bottom, indicating gradual accumulation. Avoid V-shaped formations, which suggest sharp reversals rather than steady buying. The cup’s depth should be 20–30% of the prior peak, and it typically spans 1–6 months on daily or weekly charts. - Proper Handle Formation:

The handle is a short consolidation period sloping downward slightly, lasting 1–4 weeks. It should:- Retrace 30–50% of the cup’s advance.

- Form on lower volume compared to the cup.

- Avoid steep declines, as they may indicate weakness.

- Volume Confirmation:

Volume patterns are critical:- Volume often rises during the cup’s right side as prices recover.

- Volume decreases during the handle’s formation, showing reduced selling pressure.

- A breakout above the handle’s resistance (the cup’s peak) must occur with a significant volume spike to confirm bullish momentum.

- Breakout Validation:

The pattern is complete only when the price closes above the handle’s resistance on high volume. The breakout should be sustained, with the price holding above the resistance level. A false breakout, where the price quickly falls back, invalidates the pattern.

For example, if a stock rises from $100 to $130, dips to $110 (forming a 20% deep cup), returns to $130, and then pulls back to $122 (forming a handle), a breakout above $130 on high volume confirms a valid cup and handle pattern.

Why These Rules Matter

Following these rules ensures the pattern reflects genuine bullish sentiment:

- A prior uptrend confirms the market’s bullish bias.

- A U-shaped cup shows steady accumulation, not panic selling.

- A proper handle indicates controlled consolidation before a breakout.

- Volume patterns validate buyer commitment during the breakout.

Ignoring these rules can lead to misidentifying patterns, resulting in failed trades or missed opportunities.

Common Mistakes to Avoid

- Accepting V-Shaped Cups: Sharp dips lack the accumulation phase of a true cup.

- Overlooking Volume: A breakout without volume support is likely to fail.

- Misjudging Duration: Cups shorter than a month or handles shorter than a week may lack sufficient consolidation.

- Ignoring Market Context: In a bearish market, even valid patterns may underperform.

Tools and Resources

Enhance your ability to validate cup and handle patterns with these resources:

- TradingView: A user-friendly platform for charting and pattern analysis. Visit TradingView.

- Investopedia: Provides in-depth guides on chart patterns. Learn more on Investopedia.

- StockCharts: Offers technical analysis education and pattern examples. Explore StockCharts.

Tips for Traders

- Use Charting Software: Tools like TradingView help outline the cup and handle’s shape accurately.

- Practice Patience: Wait for the breakout to confirm the pattern before trading.

- Combine Indicators: Use RSI or moving averages to support volume confirmation.

- Study Historical Charts: Analyze past patterns to understand valid formations.

FAQ Section

Q: What makes a cup and handle pattern valid?

A: A valid pattern requires a prior uptrend, U-shaped cup, proper handle, volume confirmation, and a sustained breakout.

Q: How deep should the cup be in a cup and handle pattern?

A: The cup’s depth should be 20–30% from its peak to trough, ensuring a gradual accumulation phase.

Q: Why is volume important in the cup and handle pattern?

A: Volume confirms the pattern’s strength, with low volume in the handle and a spike during the breakout.

Q: Can a cup and handle pattern form in a bearish market?

A: It can, but its reliability decreases in bearish conditions, so always check market context.

Q: How long should the handle last in a cup and handle pattern?

A: The handle typically lasts 1–4 weeks, allowing for proper consolidation before the breakout.

Conclusion

Mastering the key rules for valid cup and handle patterns is essential for spotting reliable bullish signals. By ensuring a prior uptrend, U-shaped cup, proper handle, volume confirmation, and a strong breakout, traders can confidently identify this pattern in stocks, forex, and crypto. Avoid common mistakes and leverage tools like TradingView to enhance your skills. For more insights on the cup and handle pattern, visit https://cupandhandlepattern.com/.